Short Put Calendar Spread - Web a short put calendar spread is another type of spread that uses two different put options. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on. Web a short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right to sell at two. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web in this video i have explained about short put calendar spread.

Short Put Calendar Short put calendar Spread Reverse Calendar

Web a short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right to sell at two. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Web a short put calendar spread is another type of spread that.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Web a short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right to sell at two. Web buying one put option and selling a second put option with.

Short Put Calendar Spread Options Strategy

Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on. Web a short put spread, or bull put spread,.

Short Put Calendar Spread

Web in this video i have explained about short put calendar spread. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web a short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right.

Short Put Calendar Spread Printable Calendars AT A GLANCE

Web a short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right to sell at two. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Web in this video i have explained about short put calendar spread..

Short Calendar Put Spread Staci Elladine

Web a short put calendar spread is another type of spread that uses two different put options. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on. Web buying one put option and selling a second put option with a more distant expiration is.

Calendar Put Spread Options Edge

Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on. Web a short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right to sell at two. Web in this video i have explained.

Advanced options strategies (Level 3) Robinhood

Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web in this video i have explained about short put calendar spread. Web a short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right.

How to Create a Credit Spread with the Short Calendar Put Spread YouTube

Web a short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right to sell at two. Web in this video i have explained about short put calendar spread. Web buying one put option and selling a second put option with a more distant expiration is an example of a.

Short Calendar Spread

Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Web a short put calendar spread is another type of spread that uses two different put options. Web buying one put option and selling a second put option with a more distant expiration is an example of a short.

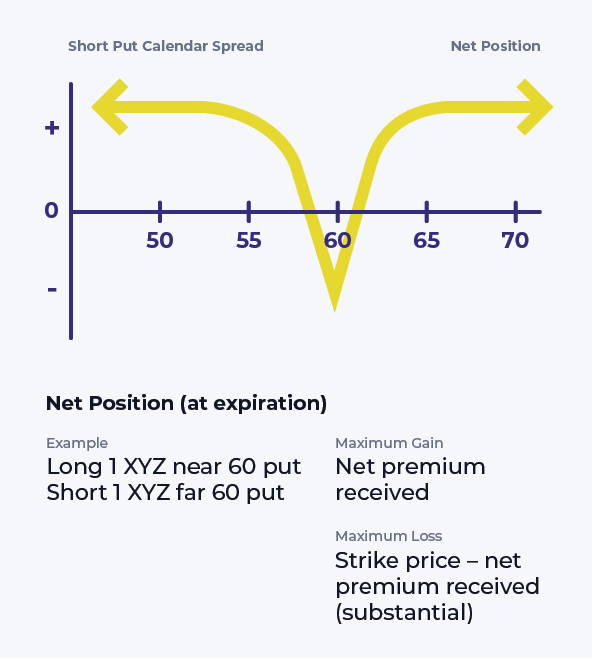

Web a short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right to sell at two. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on. Web a short put calendar spread is another type of spread that uses two different put options. Web in this video i have explained about short put calendar spread. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread.

Web In This Video I Have Explained About Short Put Calendar Spread.

Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on. Web a short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right to sell at two. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Web a short put calendar spread is another type of spread that uses two different put options.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)